Consumers lead strategic change in sustainable farming

As the battle for the food market intensifies, the key is to know exactly what consumers want – and be ready to give it to them.

Consumer demands have never been constant, but today’s market changes are threatening the sales growth of large food companies, including multinationals such as Kraft and Nestlé. Younger consumers in particular are moving toward smaller brands that are taking a stance on issues such as climate change, deforestation, single-use plastics, and fair trade. This is a significant market development that is impacting the entire food supply chain.

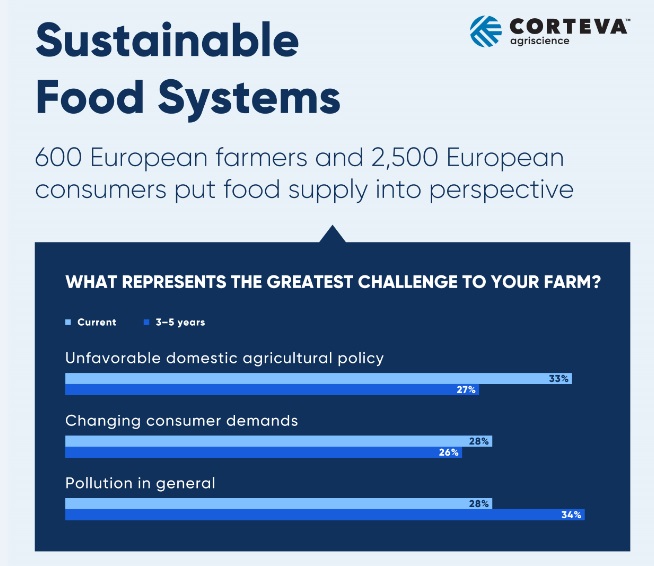

Sustainable Food Systems, a research study commissioned by Corteva and conducted by Longitude, a Financial Times Company, surveyed 600 European farm owners and managers and 2,500 European consumers to find out about these consumer expectations and how farmers are responding to them.

It found European farmers concerned by these changing consumer trends: more than a quarter (28%) say that changing consumer demands are among the greatest challenges they face today. In the UK, it is the top challenge for 39% of farmers.

More than half (56%) of the farmers believe that consumers are going to want more sustainably-produced food in future, and 42% have already changed their agricultural planning to meet that demand.

Sustainability champions take a financial hit

Some European farmers are quite far ahead in their implementation of sustainable agricultural practices such as water conservation and agroforestry. Out of the 600 farmers surveyed, 78% say they have implemented up to two sustainable practices, and 22% say they have implemented three or more sustainable practices. The study calls the latter group the “sustainability champions,” and takes a close look at how their answers to the survey compare with those of the rest of the farmers.

That comparison finds the “sustainability champions” more likely to say they are under financial pressure: 69% say they have to invest more in order to implement their sustainability practices – compared with just 24% of the rest of the farmers. And 43% of the sustainability champions say that meeting consumer demands for sustainably-produced food is subsidized by cutting profit margin in the supply chain – compared with only a quarter of the other farmers.

But consumers are ready to pitch in

Michael Goebbels, Director of Corporate Responsibility for international wholesaler Metro AG, says that food is currently sold below its worth, and before long the costs of mitigating negative impacts on the environment and society will have to be incorporated into the price of food.

The question is, which part of the food chain will shoulder that price hike? Will farmers, like the “sustainability champions” do now, have to bear the cost of sustainability? Maybe not. Sustainable Food Systems finds that 52% of European consumers are ready to expand their food budgets by up to 20% in order to buy sustainable produce.

Consumers are ready, so while the “sustainability champions” are taking a financial hit now, their investment in sustainable practices will start to pay off. In today’s market, food producers that can anticipate and respond to these consumer trends will seize the competitive advantage.